Investment X Offers to Pay You 4700

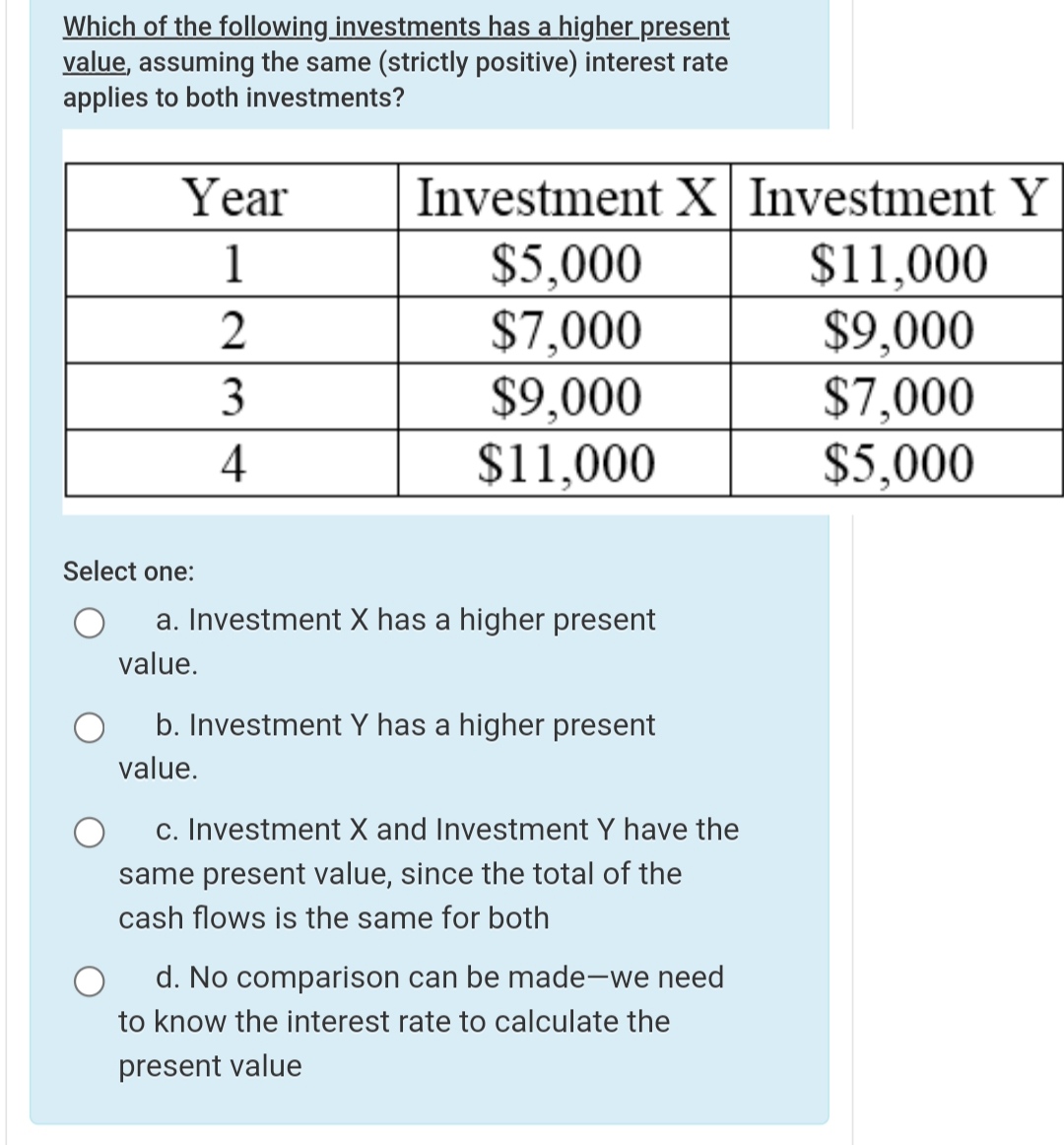

Week 2 Chapter 6 2. Both investments have a discount rate of 50.

Solved Investment X Offers To Pay You 4 700 Per Year For Chegg Com

The present value PV of an annuity is calculated by using the formula PV P1-1r-nr CASE 1.

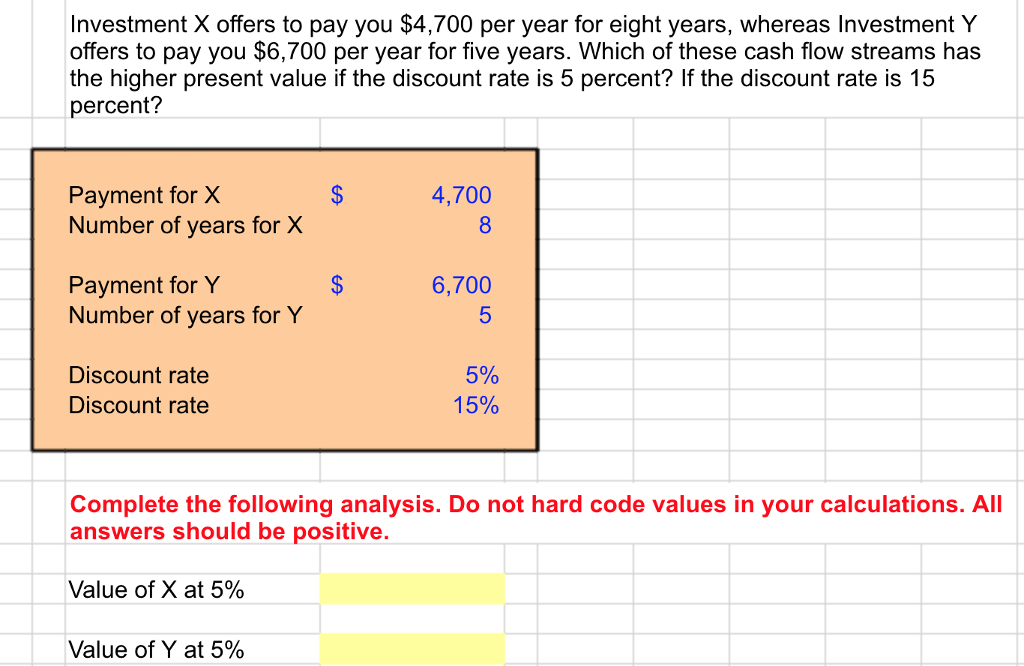

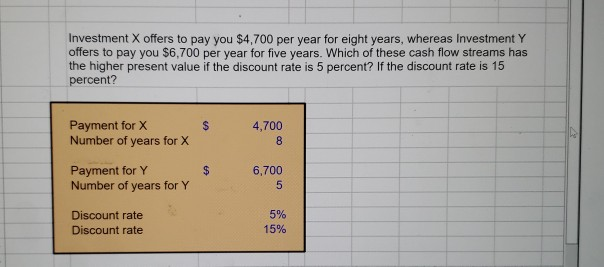

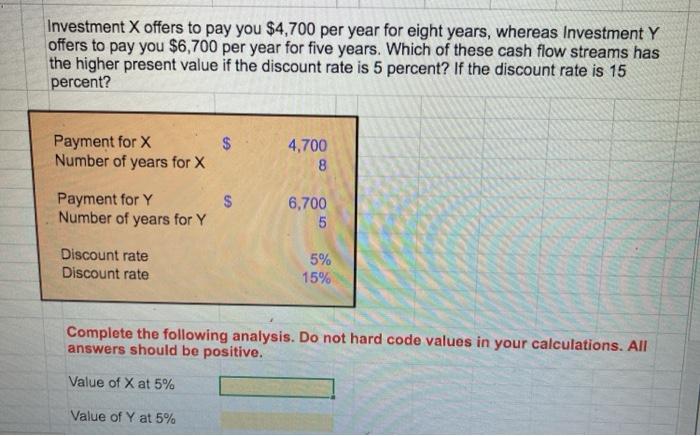

. If the discount rate is 15 percent. Investment X offers to pay you 4700 per year for. Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6700 per year for five years.

Investment X offers to pay you 4700 per year for. Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6700 per year for five years. Investment X offers to pay you 3100 per year for 9 years whereas Investment Y offers to pay you 4800 per year for 5 years.

Investment X offers to pay you 4700 per year for 9 years whereas Investment Y offers to pay you 6800 per year for 5 years. A-PVA C1 11 rt r 1At a 5 interest rate. Enter rounded answers as directed but.

First we need to calculate the final value using the following formula. If the discount rate is 6 percent what is the present value of these cash flows. A annual cash flow.

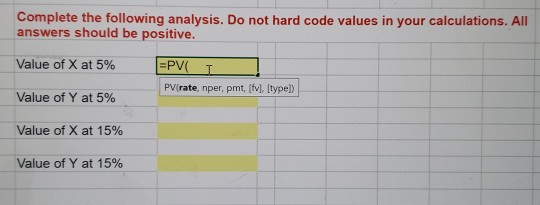

Investment x offers to pay you 4700 per year for. Do not hard code values in your calculations. Which of these cash flow streams has the higher present value if the discount rate.

If the discount rate is 15 percent. If the discount rate is 15 percent. X at 5PVA 47001 11058.

If the discount rate is 8 percent what is the present value of these cash flows. Present Value and Multiple Cash Flows LO1 Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6700 per year for five years. David answered on Dec 31 2021.

Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6700 per year for five years. Ad High-touch service and personalized solutions designed to fit your institutional needs. Which of these cash flow streams has the higher present value if the discount rate is 5 percent.

Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6700 per year for five years. Investment X offers to pay you 4700 per year for olght years whereas Investment Y offers to pay you 6700 per year for five years. Q-Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6700 per year for five yearsWhich of these cash flow streams has the higher present value if the discount rate is 5 percent.

Investment X offers to pay you 1461 per year for 19 years whereas Investment Y offers to pay you 6073 per year for 6 years. Which of these cash flow streams has the higher present value if the discount rate is 5 percent. Investment X offers to pay you 3997 per year for 18 years whereas Investment Y offers to pay you 9988 per year for 5 years.

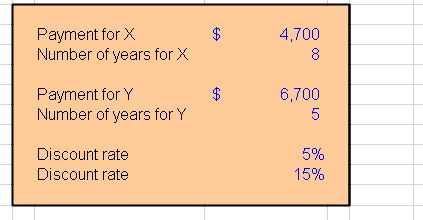

A If the discount rate is 8 percent what is the present value of these cash flows. Payment for X Number of years for X 4700 8 Payment for y Number of years. FV 47001089-1 008.

Which of these cash flow streams has the higher present value if the discount rate is 5 percent. FV 64001085-1 008. Accounting questions and answers.

Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6700 per year for five years. Which of these cash flow streams has the higher present value if the discount rate is 5 percent. Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6800 per year for five years.

Payment for X Number of years for X 4700 8 Payment for Y Number of years for Y 6700 5. Investment X offers to pay you 4700 per year for eight years whereas Investment Y offers to pay you 6700 per year for five years. Investment X offers to pay you 4700 per year for 9 years whereas Investment Y offers to pay you 6400 per year for 5.

If the discount rate is 15 percent. Investment X offers to pay you 4700 per year for 9 years whereas Investment Y offers to pay you 6400 per year for 5 years. Investment Y offers to pay you 6400 per year for 5 years.

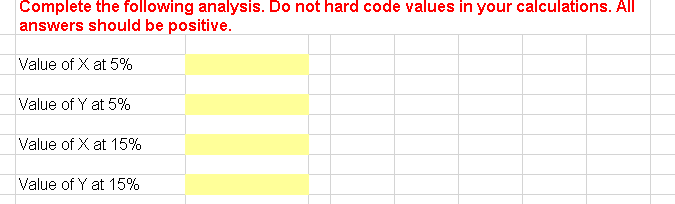

Screen mutual funds by using over 80 performance and risk metrics. Complete the following analysis. Use a Financial calculator to arrive at the answers.

Personalized financial solutions designed to fit your institutional needs. Ad FundVisualizer provides a simple intuitive and highly interactive screening process. 5 6 Payment for X Number of years for X 4700 8 7 8 Payment for Y Number of years for Y 6700.

Investment X offers to pay you 4700 per year for 9 years. Connect With A Prudential Financial Professional Via Video Phone Or In Person. Investment X offers to pay you 4700 per year for 9 years whereas Investment Y offers to pay you 6400 per year for 5 years.

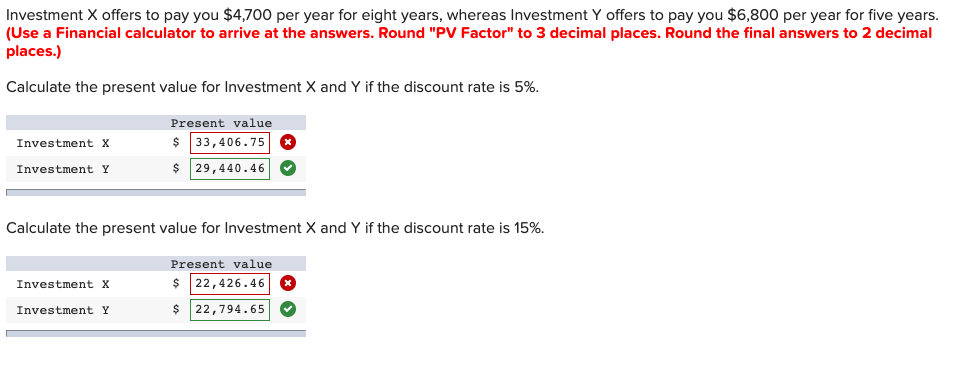

This preview shows page 3 - 4 out of 10 pages. Round the final answers to 2 decimal places Calculate the present value for Investment X and Y if the discount rate. Round PV Factor to 3 decimal places.

Do not round intermediate calculations and round your answers to 2 decimal places eg 3216 Present value Investment X Investment Y. Which of these cash flow streams has the higher present value if the discount rate is 5 percent. Enter rounded answers as directed but do not use rounded numbers in intermediate calculations.

Investment x and investment y b Which of these cash flow streams has the higher present value at 6 percent. Ad Prudential Offers Investments Designed To Keep Your Financial Life Moving Forward. Finance Assignment Assignment Description Chapter 6.

A If the discount rate is 6 percent what is the present value of these cash flows. Investment X offers to pay you 5100 per year for 9 years whereas Investment Y offers to pay you 6800 per year for 5 years. If the discount rate is 15 percent.

Discount rate r 5Present value of 4700 for 8 years. If the discount rate is 5 percent what is the present value of these cash flows. Do not round intermediate calculations and round your answer to 2 decimal places eg 3216 b.

Calculate the present value for Investment X.

Solved Investment X Offers To Pay You 4 700 Per Year For Chegg Com

Solved Investment X Offers To Pay You 4 700 Per Year For Chegg Com

Solved Investment X Offers To Pay You 4 700 Per Year For Chegg Com

Answered Which Of The Following Investments Has Bartleby

Investment X Offers To Pay You 4 700 Per Year For Eight Years Homeworklib

Why Whisky Casks Could Be A Better Investment Than You Think The Independent

Solved Investment X Offers To Pay You 4 700 Per Year For Chegg Com

Solved Investment X Offers To Pay You 4 700 Per Year For Chegg Com

Investment X Offers To Pay You 4 700 Per Year For Eight Years Homeworklib

10 12g A 1 Ianthusform1012ga Htm Form 10 12g A U S

Answered Which Of The Following Investments Has Bartleby

Solved Investment X Offers To Pay You 4 700 Per Year For Chegg Com

Investment X Offers To Pay You 4 700 Per Year For Eight Years Whereas Investment Y Offers Homeworklib

Investment X Offers To Pay You 4 700 Per Year For Eight Years Homeworklib

Investment X Offers To Pay You 4 700 Per Year For Eight Years Homeworklib

Investment X Offers To Pay You 4 700 Per Year For Eight Years Homeworklib

Comments

Post a Comment